About once a quarter someone comments on an article or shares a story about how churches should be taxed. It’s an understandable thought. Few things sicken me as much as the lavish lifestyles of televangelists and their spiritually abusive ways. They fly jets, build McMansions, and bank millions of dollars all while claiming to be religious entities which are free from federal taxes. It’s sad. While we must be careful not to infringe on the religious freedoms of individuals and to protect the separation of church and state (that’s a good phrase when it refers to the government staying out of the church), I would be for a common-sense solution to make sure those who are getting tax exemptions are actually doing religious work. (For an example of fraud in the name of Jesus, consider these six preachers)

Yet the answer is not to tax all churches.

A Tornado and Then a Flood

One story never told is the economic impact a church brings to its community. Recently a flood hit my hometown. Homes that never flooded before faced the possibility of being inundated with water. A week before the river began to rise, a small tornado hit our community. It damaged a few homes. While several church members helped others in need, our church’s lack of an organized response troubled me. It showed we weren’t ready for a bigger crisis.

The tornado happened on a Saturday. On Monday I spoke with our staff about the need for a better response. On Tuesday several staff members discussed a better process. By Thursday night, the first forecasts of possible flooding were made. On Friday morning, those same staff members put together a plan of how we could serve. By Friday of Memorial Day weekend, we had sand and sandbags in our church parking lot to help nearby homes.

Over the next three weeks, hundreds of volunteers gave their time and effort to provide relief, then recovery, and finally rebuilding from the historic floods.

Our church was just one of many churches to serve during this time. We did not have a monopoly on the good that was done. However, the statistics from our church begin to paint the bigger picture of the economic value of the Church.

What We Don’t Give in Taxes

What if churches in America were taxed? Obviously, there are multiple ways to consider taxes for religious institutions, but the two biggest taxes are income and property. As a non-profit, we would likely avoid any income taxes because all revenue is spent on nearly a yearly basis. Like most churches, we do everything we can to assist as many people as we can. Profits are not something we make.

Yet we do have property and by choosing to not tax that property, our community is missing out on some funds. Our building in Fort Smith is worth about $3.5 million dollars. With a .20 assessment rate and a current millage of .0588, our property tax would be about $40,000 a year.

That’s a lot of money and we are just one church. This means our community is missing out on a good amount of money because we are tax exempt. (This isn’t just a church issue. A local for-profit hospital just sold to a non-profit company and the change in status greatly impacted our town’s income based off of property taxes.)

Each year, we don’t give $40,000 which the government could demand that we turn over.

What We Do Give Beyond Taxes

While we don’t pay property taxes, we do invest a good amount of money back into our community. Just this past week, the city hosted a meeting, a local business held staff development, and multiple groups met for during recovery programs in our building. All of this space was used for free.

Each year we spend more than $40,000 in our Angel Tree ministry which provides gifts for children who have at least one parent in prison. Those gifts are given not in the name of the church, but in the name of the parent who cannot purchase gifts on their own. (See: A True Picture of Justice and Grace)

But consider the economic impact of just three weeks during the 2019 Arkansas River flood.

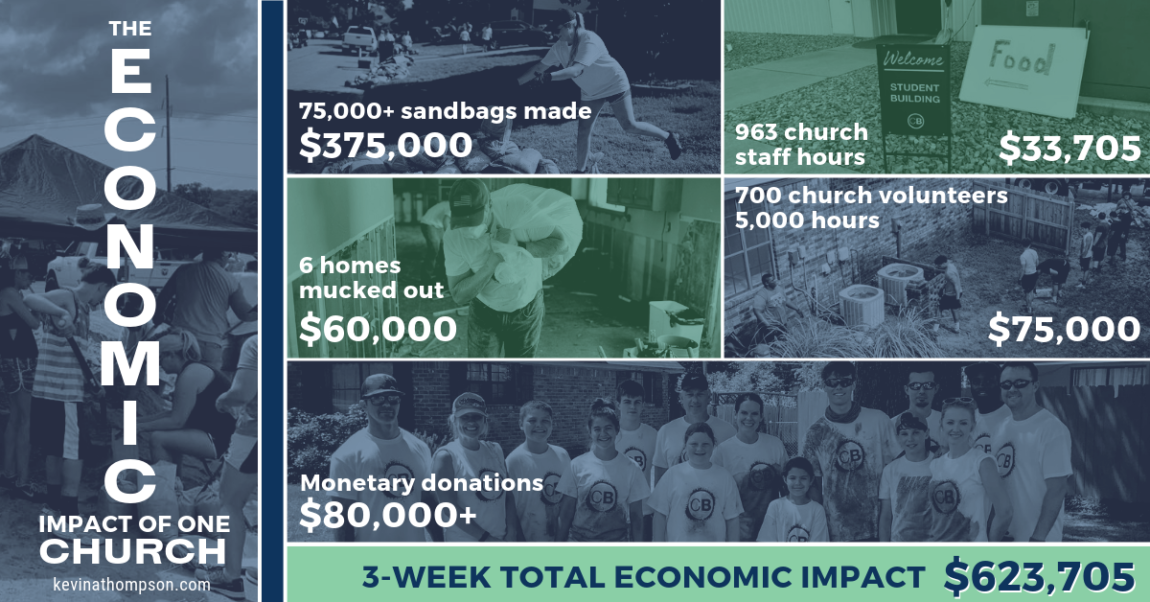

Our church produced over 75,000 sandbags: making them, hauling them, placing them, and then retrieving them when the flood was over. A local hardware store owner said pre-made sandbags retail at $7 each. So let’s say our sandbags were only $5. This is a $375,000 contribution to our community.

In three weeks, our staff worked 963 hours in helping our community with flood relief. This is everything from helping people move furniture to assisting the city/county in making decisions to using our church as a feeding center. At $35/hour, this is a $33,705 gift to our community.

During the same time, our church had around 700 volunteers who gave their time to serve others. They gave over 5,000 volunteer hours. Most of that time required landscape type activities. On average, landscapers charge $35/hour. To be conservative and since we are amateurs, let’s say our labor was only worth $15/hour. That’s a contribution of $75,000 to our community.

One of the most difficult jobs regarding flood recovery is mucking out homes with water damage. In each home, everything within two feet of the water line has to be torn out and thrown away. This work is often done in the heat and humidity amidst an overwhelming stench. Professional services give estimates of up to $20,000 for one house. Again, we are amateurs so let’s say our work is only worth $10,000. We did six houses making a total contribution of $60,000.

Our people are very generous. As soon as the need was seen, people began to ask what they could give to assist others. We chose to not only promote online giving, but also to take one Sunday and ask people to give to flood relief through our offering. We promised that every dollar given would go directly to people impacted by the flood. To date, our people have given over $80,000.

That’s a total of $623,705 given to our community in three weeks. Obviously, this was a unique event. We don’t have this kind of expense on a yearly basis. However, there is no question that if something happened tomorrow, our people would do the exact amount of giving again.

We Are Just One Example

We are just one church. I can cite what we did simply because I know the inside story and can run the numbers. What I can’t specifically calculate is all the work many churches did in a short span of time. My guess is that the work would easily have a dollar amount that would top $1 million. (See: When It’s Cool to Mock Christianity)

There is an aspect of me that wouldn’t mind churches paying property taxes. Maybe, in part, it would cut down on some of the scam artists who use religion in order to make themselves rich. Yet I worry that taxing the church would do more harm than good. For our church, it would mean fewer resources to help those around us. For other churches, it could threaten their existence and end meaningful communities for some of our most vulnerable citizens.

5 Responses to The Economic Impact of One Church